Portfolio Landlords - BTL Mortgages

Free BTL Quote/Rate Comparison ✅

Trusted By Property Professionals Nationwide ✅

Get In Touch Today ✅

Free BTL Quote/Rate Comparison ✅ Trusted By Property Professionals Nationwide ✅ Get In Touch Today ✅

Hours

Monday–Friday

9am–6pm

Email

info@thefundinggroup.co.uk

Phone

08000 699 500

Location

Southgate Chambers, 37 Southgate Street, Winchester, SO23 9EH

Smart, Strategic Mortgages for Long-Term Portfolio Success ✅

Rates From 2.99% ✅

Same Day BTL Assessment ✅

Long-Term Property Strategies ✅

Up to 85% LTV Available ✅

New LTDs/SPVs (No History) ✅

Interest Only or Repayment ✅

Quick Completions ✅

Desktop Valuations Possible ✅

Bridging Loan Exits ✅

Why Portfolio Landlord Mortgages Matter

If you own four or more rental properties, most lenders class you as a portfolio landlord — meaning your mortgage needs become more specialised. Portfolio landlord mortgages give you access to flexible underwriting, better stress tests, and lenders who understand complex or high-yield property strategies.

They’re ideal when:

✅ You own multiple BTLs, HMOs, MUFBs or mixed-use properties

✅ You want to refinance several mortgages at once

✅ You need more generous affordability calculations

✅ You want lenders who consider your entire portfolio performance

✅ You’re actively growing or restructuring your portfolio

✅ You’re using a Limited Company or SPV structure

At The Funding Group, we specialise in navigating complex, multi-property applications quickly and clearly.

Common Portfolio Landlord Scenarios

We help portfolio clients with:

📦 Refinancing several properties under one lender

🏘️ Funding for HMOs, MUFBs, and high-yield investments

📈 Releasing equity across a portfolio for new projects

🔁 Consolidating scattered lenders into a single structure

💼 Incorporating personal BTLs into a Limited Company

📊 Improving cash flow through rate optimisation

🏗️ Bridge-to-let or BRRR strategies at scale

If your portfolio is growing — or needs reorganising — we find the lender that aligns with your long-term plans.

How We Work

Complex portfolios require a smooth, efficient process.

📞 Initial Chat (Same Day)

We review your entire portfolio, rental income, existing lending, and desired outcomes.

📊 Portfolio Analysis & Terms Within 24 Hours

We identify lenders suited to your strategy — whether you want better rates, more leverage, or simplified management.

🏠 Valuations & Underwriting

We coordinate multiple valuations and package your portfolio neatly for the lender to fast-track approval.

💷 Completion With Full Support

We manage the entire process — refinancing, releases, restructures — with minimal disruption.

You get cleaner lending, clearer planning, and structured long-term growth.

Why Portfolio Landlords Choose The Funding Group

We offer:

📈 Lenders who understand large property portfolios

📦 Multi-property refinancing and consolidation

💷 Access to higher loan amounts and flexible stress tests

🔁 Bridge-to-let support at portfolio scale

📊 Strategic planning for long-term expansion

💡 A specialist team that makes complex cases simple

We don’t just source the mortgage — we structure your entire portfolio strategy for success.

Need Portfolio Landlord Support? We’ll Make It Simple

Whether you want to refinance, expand, or restructure — we guide you through every step.

👉 Get a same-day portfolio review or call 08000 699 500

Portfolio Landlord FAQs – Answered

Do I need to submit a full portfolio spreadsheet?

Yes — lenders require a schedule of properties, mortgages, values, and rents.

Will my whole portfolio be stress tested?

Often yes, but some lenders use “top-slicing” or more flexible calculations.

Can I refinance multiple properties at once?

Absolutely — we specialise in portfolio-wide refinancing.

Trusted By Property Professionals Nationwide ✅

It makes us proud that our clients come back to us over and over again…. It’s due to our market leading service that sets us apart from the rest. We understand that you may have existing broker relationships, but why not give us a try and get a free quote/rate comparison.

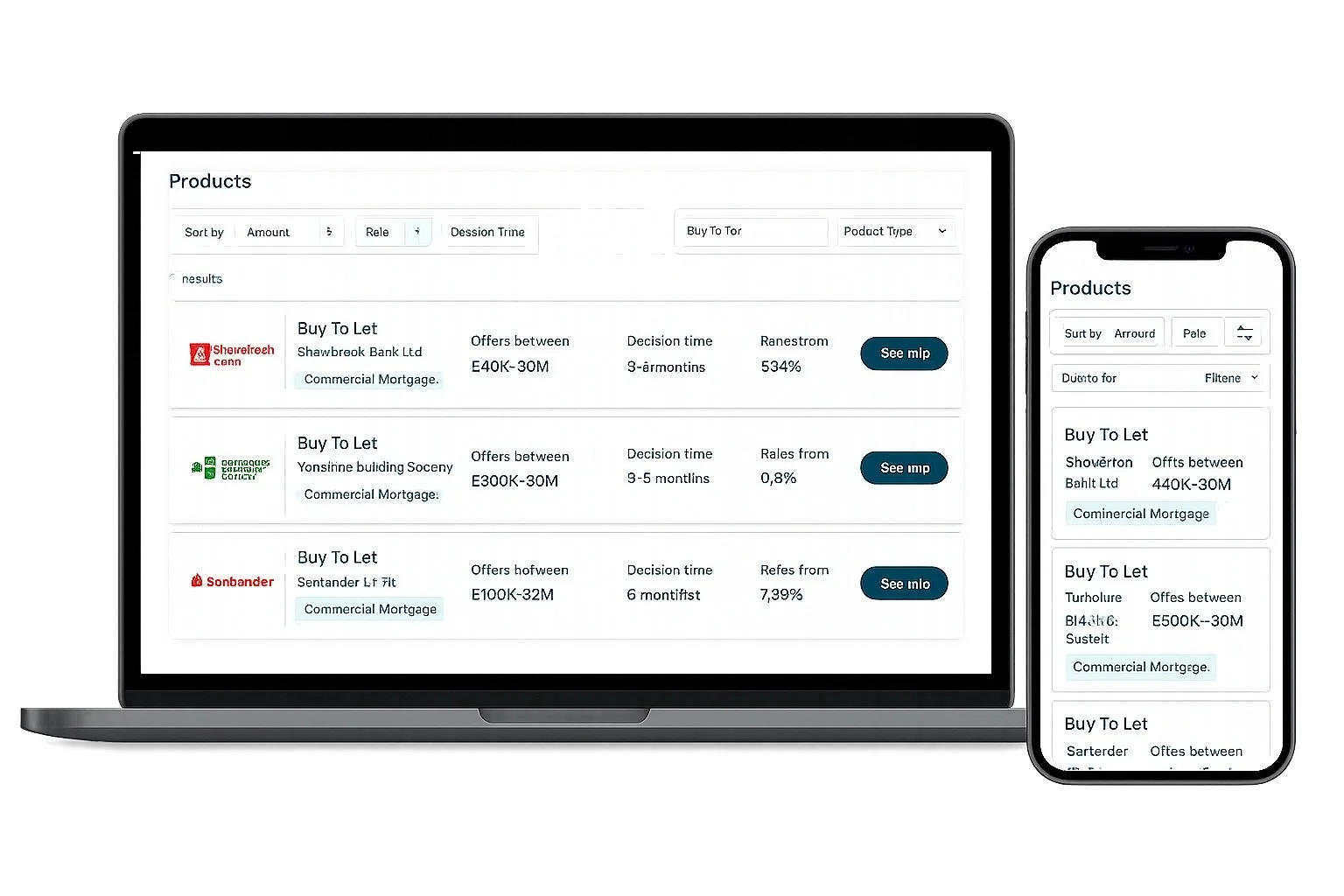

Access The Best Rates

We’ll compare the top lenders in the market to find the best deal for you and your business. With access to 160+ lenders we’ve got the key to unlock the funding you need.

No Upfront Broker Fees ✅

We only get paid when the job is done, we don’t ask for any payment upfront for our time and services. That’s just part of our market leading service.