LTD Companies/SPVs - BTL Mortgages

Free BTL Quote/Rate Comparison ✅

Trusted By Property Professionals Nationwide ✅

Get In Touch Today ✅

Free BTL Quote/Rate Comparison ✅ Trusted By Property Professionals Nationwide ✅ Get In Touch Today ✅

Hours

Monday–Friday

9am–6pm

Email

info@thefundinggroup.co.uk

Phone

08000 699 500

Location

Southgate Chambers, 37 Southgate Street, Winchester, SO23 9EH

Smart, Strategic Mortgages for Long-Term Portfolio Success ✅

Rates From 2.99% ✅

Same Day BTL Assessment ✅

Long-Term Property Strategies ✅

Up to 85% LTV Available ✅

New LTDs/SPVs (No History) ✅

Interest Only or Repayment ✅

Quick Completions ✅

Desktop Valuations Possible ✅

Bridging Loan Exits ✅

Why Use Limited Company / SPV Buy-to-Let Mortgages

Limited Company and SPV (Special Purpose Vehicle) mortgages are now the most popular structure for property investors. They allow you to purchase and hold rental properties tax-efficiently, scale your portfolio faster, and access more flexible underwriting from lenders.

They’re ideal when:

✅ You want to grow a portfolio through a Limited Company

✅ You need tax-efficient property ownership

✅ You’re buying HMOs, MUFBs, or higher-yield investments

✅ You want easier future refinancing and portfolio management

✅ You want to separate personal finances from property investments

✅ You’re planning long-term portfolio growth

At The Funding Group, we specialise in helping investors secure competitive BTL mortgages through SPVs and limited companies.

Common SPV / Ltd Company Mortgage Use Cases

We help landlords and companies with:

🏘️ Standard single-let buy-to-lets

🏡 HMOs, MUFBs, and co-living investments

🏢 Semi-commercial or mixed-use properties

🔁 Bridge-to-Let exits using SPV structures

📦 Portfolio refinancing and restructuring

📈 Scaling property portfolios with multiple acquisitions

🏗️ Refinancing after refurbishment, conversions, or value-add projects

We work with lenders who specialise in property-focused companies and understand SPV structures inside out.

How We Work

Setting up and financing an SPV can feel complex — we make it simple.

📞 Initial Chat (Same Day)

We assess your property type, rental figures, structure (Ltd/SPV), and tax considerations.

📄 Indicative Terms Within 24 Hours

We match your case with lenders who offer the lowest stress tests and best rates for SPVs.

🏢 Valuation & Company Underwriting

We coordinate valuations and ensure lender requirements for SPV documentation are fully met.

💷 Smooth, Fast Completion

Most SPV mortgages complete within 4–6 weeks, depending on property type.

We guide your company through the full process to keep everything smooth.

Why Investors Choose The Funding Group

We help you:

📈 Build and scale your portfolio in a tax-efficient structure

🏘️ Access specialist SPV lenders with competitive terms

🔁 Refinance BRRR or bridge-to-let projects

💼 Simplify underwriting for new Limited Companies

📊 Secure better affordability through company-based stress tests

💡 Get expert support on structuring your lending strategy

You get long-term clarity, stronger mortgage options, and a streamlined investment journey.

Need an SPV or Ltd Company Mortgage? We’ll Set You Up Correctly

We make SPV mortgages easy — whether you’re a first-time investor or a portfolio landlord.

✅ Fast decisions

✅ Expert structure guidance

✅ Full end-to-end support

👉 Get a same-day quote or call 08000 699 500

SPV Mortgage FAQs – Answered

Can a brand-new Limited Company get a mortgage?

Yes — SPVs with no history are accepted by most lenders.

Do I need to give a personal guarantee?

Usually yes, but exposure depends on loan structure.

Is an accountant required?

Not always — but good tax advice is recommended.

What rates are available?

Rates depend on property type but often start around 3-4%.

Trusted By Property Professionals Nationwide ✅

It makes us proud that our clients come back to us over and over again…. It’s due to our market leading service that sets us apart from the rest. We understand that you may have existing broker relationships, but why not give us a try and get a free quote/rate comparison.

Access The Best Rates

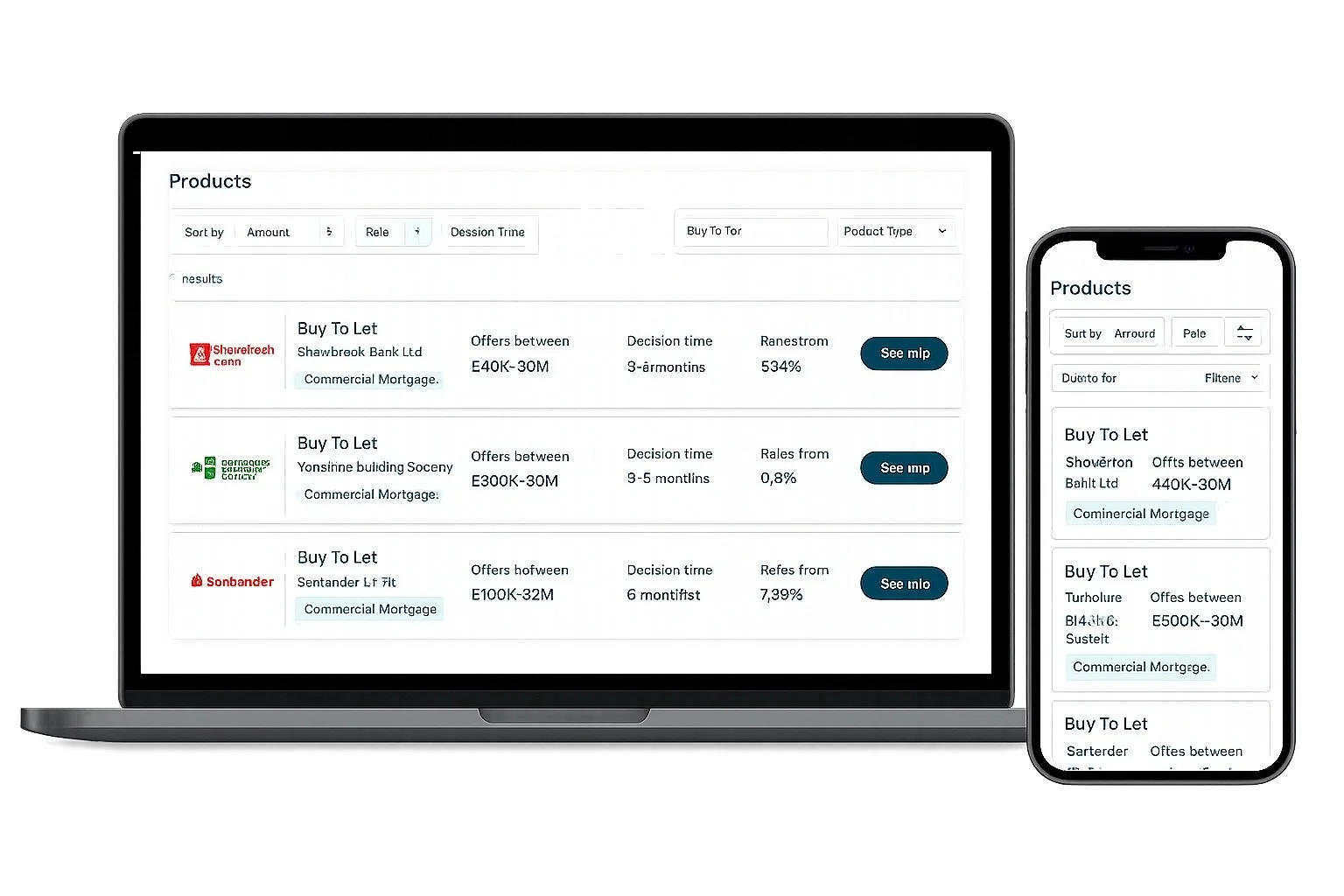

We’ll compare the top lenders in the market to find the best deal for you and your business. With access to 160+ lenders we’ve got the key to unlock the funding you need.

No Upfront Broker Fees ✅

We only get paid when the job is done, we don’t ask for any payment upfront for our time and services. That’s just part of our market leading service.