Business Finance

Business Loans ✅

Venture Capital ✅

Asset Finance ✅

Acquisition Finance ✅

Working Capital ✅

Vehicle Finance ✅

Business Loans ✅ Venture Capital ✅ Asset Finance ✅ Acquisition Finance ✅ Working Capital ✅ Vehicle Finance ✅

Free Business Finance Quote

Completely free, no obligation and no credit checks, we’ll let you know if you’re likely to qualify for the funding that you’re looking for.

Hours

Monday–Friday

9am–6pm

Email

info@thefundinggroup.co.uk

Phone

08000 699 500

Location

Southgate Chambers, 37 Southgate Street, Winchester, SO23 9EH

Business Finance Services

View our full range of business finance services via the drop down section beneath and click the text to find out more

Smart, Strategic BTL Mortgages for Long-Term Portfolio Success ✅

Rates From 2.99% ✅

Same Day BTL Assessments ✅

Long-Term Property Strategies ✅

Up to 85% LTV Available ✅

New LTDs/SPVs (No History) ✅

Interest Only or Repayment ✅

Quick Completions ✅

Desktop Valuations Possible ✅

Bridging Loan Exits ✅

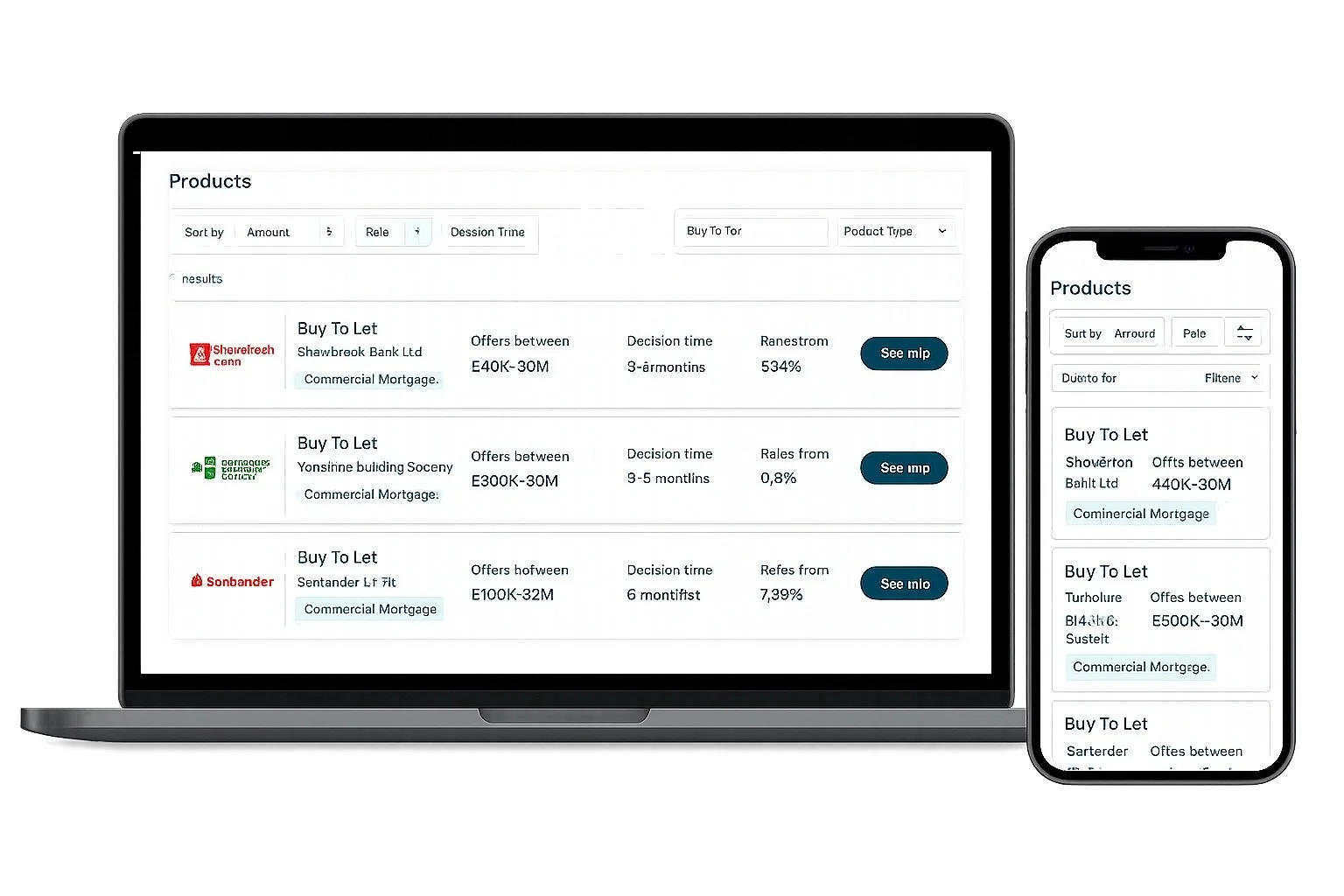

Access The Best Rates

We’ll compare the top lenders in the market to find the best deal for you and your business. With access to 160+ lenders we’ve got the key to unlock the funding you need.

No Upfront Broker Fees ✅

We only get paid when the job is done, we don’t ask for any payment upfront for our time and services. That’s just part of our market leading service.