Bridge-To-Let Finance - Bridging Loans

Free Bridging Quote/Rate Comparison ✅

Trusted By Property Professionals Nationwide ✅

Get In Touch Today ✅

Free Bridging Quote/Rate Comparison ✅ Trusted By Property Professionals Nationwide ✅ Get In Touch Today ✅

Hours

Monday–Friday

9am–6pm

Email

info@thefundinggroup.co.uk

Phone

08000 699 500

Location

Southgate Chambers, 37 Southgate Street, Winchester, SO23 9EH

Fast, Flexible Bridging Finance When You Need It Most ✅

Rates From 0.55% Per Month ✅

Same Day Terms Offered ✅

Desktop Valuations Possible ✅

New SPVs (No History) ✅

Up to 90% Purchase Price ✅

Retained Interest Option ✅

Quick Completions ✅

Exits on to BTL Mortgage ✅

Below Market Value ✅

Why Use Bridge-to-Let Finance?

If you’re buying a property that needs a quick purchase and light-to-heavy refurbishment before refinancing onto a long-term mortgage, bridge-to-let finance gives you the speed and flexibility you need — with a clear exit already built in.

It’s the ideal solution when:

🏡 You’re buying a property that isn’t mortgage-ready yet

🔧 You want to refurbish before refinancing

⚡ You need to complete quickly (auctions, chain breaks, private sales)

📈 You want to boost rental yield and value before moving onto a BTL mortgage

💰 You want a smooth transition from short-term funding → long-term debt

Bridge-to-let lets you buy fast, add value, stabilise rental income, and then refinance onto a low-rate buy-to-let product with minimal friction.

What Bridge-to-Let Finance Covers

We help landlords and investors use bridge-to-let for:

🛠️ Refurbishment Projects

Buy → refurbish → refinance based on the improved value.

🏚️ Unmortgageable Properties

Perfect for homes needing kitchens, bathrooms, heating systems, or compliance upgrades.

🚀 BRRR Strategy

Buy, Refurbish, Rent, Refinance — executed smoothly with one funding line.

🏘️ Portfolio Expansion

Buy quickly, improve, refinance, release capital, repeat.

⚡ Fast Acquisitions

Ideal for auction buys or competitive private deals that require 28-day completion.

How Bridge-to-Let Works

Bridge-to-let lenders typically offer:

💷 Up to 75% of purchase price

🔧 100% refurb cost coverage (in stages)

📈 Refinancing based on the new valuation

🏦 A direct move to long-term BTL mortgages once works are complete

Once refurb is finished and the property is lettable, lenders will:

✔ Revalue the property

✔ Move you onto their BTL product

✔ Pay off the bridging balance

All within one smooth, integrated process.

How We Work

We make bridge-to-let simple and stress-free.

📞 Initial Chat — Same Day

We assess the deal, refurb requirements, and your rental strategy.

📄 Indicative Terms in 24 Hours

We match you with lenders who specialise in value-add projects.

🔍 Valuation & Fund Release

We coordinate with lenders, valuers, and surveyors so refurb funds are released on time.

💷 Fast Completions

Most clients complete the bridge within 10–14 days.

We manage the entire journey — from acquisition to refinance.

Why Investors Choose The Funding Group

With bridge-to-let, we help you:

🔥 Maximise uplift before refinancing

📈 Secure higher rental income and valuations

🔧 Access specialist refurb + BTL lenders

🏘️ Grow your portfolio using BRRR strategies

⚡ Move quickly on competitively priced deals

🏦 Transition smoothly to long-term lending

We're here to support the full lifecycle of your investment — not just arrange a loan.

Power Your Rental Strategy With Smart Bridge-to-Let Finance

Buy fast. Add value. Refinance smoothly. Grow your portfolio the right way.

👉 Get a same-day quote or call 08000 699 500

Bridge-to-Let FAQs

Do I need to refinance with the same lender?

Not always — but most lenders offer better terms if you stay with them.

Can I refinance based on the new value?

Yes, once refurb is complete and the property is lettable.

Are refurb costs fully funded?

Yes, if the GDV and works schedule support the loan.

What rates are available?

Bridging from 0.55% per month. BTL rates vary based on credit and rental income.

Trusted By Property Professionals Nationwide ✅

It makes us proud that our clients come back to us over and over again…. It’s due to our market leading service that sets us apart from the rest. We understand that you may have existing broker relationships, but why not give us a try and get a free quote/rate comparison.

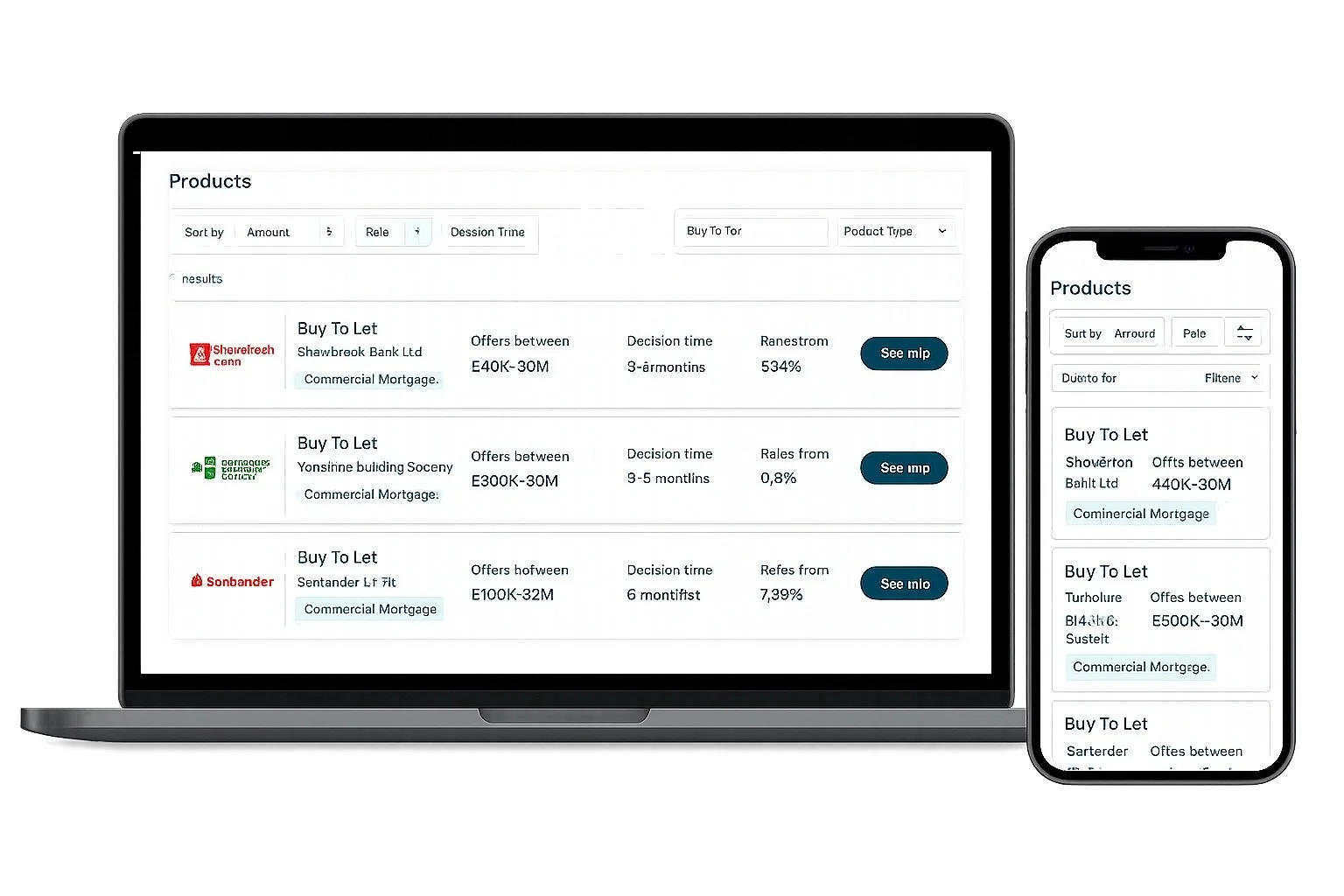

Access The Best Rates

We’ll compare the top lenders in the market to find the best deal for you and your business. With access to 160+ lenders we’ve got the key to unlock the funding you need.

No Upfront Broker Fees ✅

We only get paid when the job is done, we don’t ask for any payment upfront for our time and services. That’s just part of our market leading service.