90% Purchase Price - Bridging Loans

Free Bridging Quote/Rate Comparison ✅

Trusted By Property Professionals Nationwide ✅

Get In Touch Today ✅

Free Bridging Quote/Rate Comparison ✅ Trusted By Property Professionals Nationwide ✅ Get In Touch Today ✅

Hours

Monday–Friday

9am–6pm

Email

info@thefundinggroup.co.uk

Phone

08000 699 500

Location

Southgate Chambers, 37 Southgate Street, Winchester, SO23 9EH

Fast, Flexible 90% Bridging When You Need It Most ✅

Rates From 0.6% Per Month ✅

Same Day Terms Offered ✅

Desktop Valuations Possible ✅

New SPVs (No History) ✅

Up to 90% Purchase Price ✅

Retained Interest Option ✅

Quick Completions ✅

Exits on to BTL Mortgage ✅

Below Market Value ✅

Why Use 90% Purchase Price Bridging?

If you’ve found a great property deal but don’t want to tie up a large deposit, 90% purchase price bridging gives you the leverage to move fast with minimal upfront capital. It’s the ideal solution for investors and developers wanting to maximise returns or secure opportunities that rely on speed.

90% bridging is perfect when:

💷 You want to reduce your deposit and retain cash for refurbishments

⚡ The property needs to complete quickly (auction, off-market, distress sale)

🏷️ The deal is strong with a clear uplift or discount

🏗️ You’re planning a refinance based on a higher GDV or valuation

📉 You’re purchasing below market value and want to leverage the discount

At The Funding Group, we work with specialist lenders who offer high leverage bridging — even when mainstream lenders won’t.

Common Use Cases for 90% Bridging

We help investors access high-LTV bridging for:

🏚️ BMV purchases where the lender lends against OMV

🔧 Light or heavy refurb projects

📈 Flip opportunities with proven uplifts

🏡 Auction deals with tight deadlines

💼 Portfolio acquisitions where leverage is key

🚀 Off-market deals requiring fast commitment

High-leverage bridging lets you stretch your capital further — especially when paired with a strong exit.

How 90% Bridging Works

Lenders offering 90% bridging typically assess:

1️⃣ The strength of the deal (discount, uplift potential, condition)

2️⃣ Your exit strategy (refinance or sale)

3️⃣ The open market value (OMV)

4️⃣ Refurbishment or value-add plan

Many lenders allow:

💸 10% deposit from you

🔧 Refurbishment costs funded separately

🏷️ Loan calculated against the higher OMV

This makes it possible to:

minimise upfront capital

maximise ROI

move fast on high-margin opportunities

How We Work

We secure high-LTV loans by preparing the deal properly and matching you with the right lender.

📞 Initial Call — Same Day

We assess the deal, discount, and uplift potential.

📄 Terms Within 24 Hours

We approach lenders who specialise in high-leverage bridging.

🏘️ Valuation & Legal Support

We coordinate everything to ensure the case progresses quickly.

💷 Fast Completion

Most 90% bridging deals complete in 7–14 days, with faster options available.

Why Investors Choose The Funding Group

We help investors:

🔥 Maximise leverage on strong deals

📉 Reduce deposits as low as 10%

🏗️ Combine high-LTV bridging with refurb cost loans

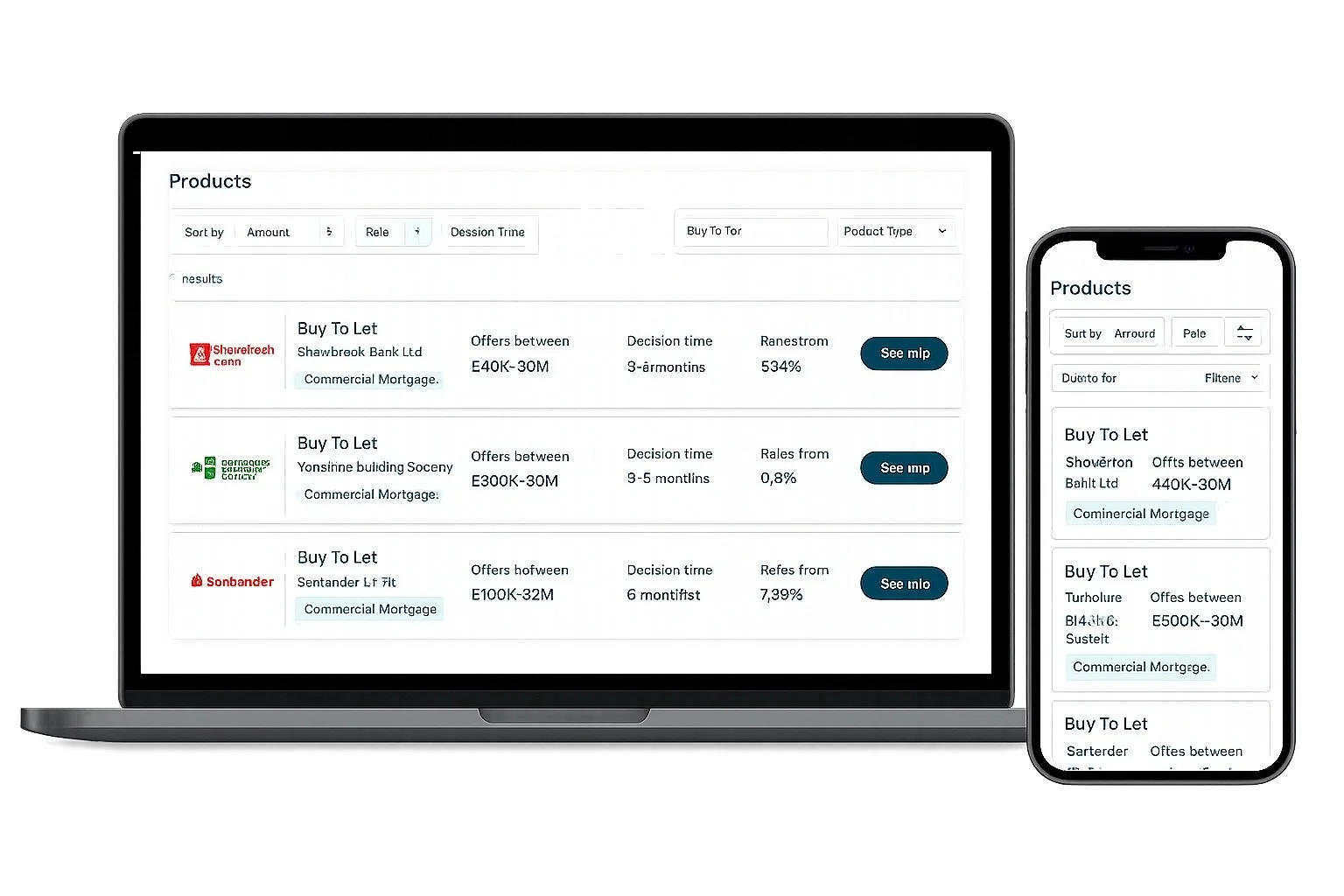

📊 Compare high-leverage lenders side-by-side

⚡ Move quickly before deals are lost

With our access to specialist lenders, you get the speed and leverage needed to secure competitive opportunities.

Get 90% Bridging Finance With Confidence

Whether you're buying BMV, refurbing for uplift, or grabbing an auction bargain — we help you fund it fast.

👉 Get a same-day quote or call 08000 699 500

FAQs

Can I really borrow 90% of the purchase price?

Yes — subject to valuation, discount, condition, and exit.

Will lenders also fund refurb costs?

Often yes, as a separate facility.

What rates apply?

Rates start around 0.60% per month, depending on leverage and risk.

Is experience required?

It helps, but some lenders consider first-time investors with strong deals.

Trusted By Property Professionals Nationwide ✅

It makes us proud that our clients come back to us over and over again…. It’s due to our market leading service that sets us apart from the rest. We understand that you may have existing broker relationships, but why not give us a try and get a free quote/rate comparison.

Access The Best Rates

We’ll compare the top lenders in the market to find the best deal for you and your business. With access to 160+ lenders we’ve got the key to unlock the funding you need.

No Upfront Broker Fees ✅

We only get paid when the job is done, we don’t ask for any payment upfront for our time and services. That’s just part of our market leading service.