Bridging Exits - BTL Mortgages

Free BTL Quote/Rate Comparison ✅

Trusted By Property Professionals Nationwide ✅

Get In Touch Today ✅

Free BTL Quote/Rate Comparison ✅ Trusted By Property Professionals Nationwide ✅ Get In Touch Today ✅

Hours

Monday–Friday

9am–6pm

Email

info@thefundinggroup.co.uk

Phone

08000 699 500

Location

Southgate Chambers, 37 Southgate Street, Winchester, SO23 9EH

Smart, Strategic Mortgages for Long-Term Portfolio Success ✅

Rates From 2.99% ✅

Same Day BTL Assessment ✅

Long-Term Property Strategies ✅

Up to 85% LTV Available ✅

New LTDs/SPVs (No History) ✅

Interest Only or Repayment ✅

Quick Completions ✅

Desktop Valuations Possible ✅

Bridging Loan Exits ✅

Why Use Bridging Exit Mortgages

A bridging exit mortgage is designed for landlords and investors who need long-term financing after completing a refurbishment, conversion, or a short-term bridge. If you’ve increased the property’s value, improved its rental potential, or simply need to settle an expiring bridge, a bridging exit mortgage gives you a smooth, stable transition onto long-term buy-to-let terms.

Bridging exit mortgages are perfect when:

✅ Your refurbishment project is finished and ready to refinance

✅ Your bridging loan is approaching expiry

✅ You want to pull out equity after increasing the property’s value

✅ You’re converting from bridge-to-let (BRRR strategy)

✅ You purchased below market value and want to refinance at the higher valuation

✅ You want predictable long-term repayments at competitive rates

At The Funding Group, we specialise in fast, flexible refinancing — ensuring your exit is smooth, stress-free, and timed perfectly.

Common Bridging Exit Use Cases

We help investors refinance:

🏚️ Refurbishment projects after light or heavy works

📈 Properties with strong rental uplift after renovations

🏘️ HMOs and MUFBs converted from standard residential properties

🔁 Bridge-to-Let (BRRR) exits

💷 Below market value purchases refinanced onto full market valuation

🏠 Properties previously unmortgageable but now fully improved

🧱 Semi-commercial or mixed-use investments

Every bridging exit is different — we tailor the lender and structure around your timeline, valuation, and rental income.

How We Work

Speed and accuracy are critical with bridging exits — here’s how we handle it:

📞 Initial Chat (Same Day)

We check your bridge expiry date, rental figures, valuation expectations, and preferred terms.

📄 Indicative Terms Within 24 Hours

We match your case with lenders experienced in exit finance, BRRR strategies, and refurbished properties.

🏠 Valuation & Underwriting

We organise valuations promptly and package your documents clearly for fast approvals.

💷 Fast Completion

Most bridging exit mortgages complete within 4–6 weeks — or sooner for urgent cases.

We manage everything smoothly to prevent costly extension fees or rushed decisions.

Why Investors Choose The Funding Group

With us, you gain:

⏳ Fast, reliable exits from bridging loans

📈 Access to lenders comfortable with newly refurbished properties

🔁 BRRR-friendly underwriting for maximum uplift

💷 Competitive rates based on the improved valuation

📉 Support avoiding bridge extension fees or default costs

💡 Experienced guidance every step of the way

We don’t just refinance your bridge — we protect your timeline, profit, and exit strategy.

Need a Bridging Exit Mortgage? We’ll Get It Sorted

Secure your exit with confidence.

✅ Fast decisions

✅ Clear guidance

✅ Full end-to-end support

👉 Get a same-day quote or call 08000 699 500

Bridging Exit FAQs – Answered

Can I refinance based on the new value (post-works)?

Yes — many lenders offer “market value” refinancing after works are complete.

Do I need a fully let property to refinance?

Not always. Some lenders accept projected rental income.

Can I refinance early?

Yes — some lenders allow refinancing even before the bridge term ends.

What rates are available?

Rates depend on rental income and valuation but typically start around 3-4%.

Trusted By Property Professionals Nationwide ✅

It makes us proud that our clients come back to us over and over again…. It’s due to our market leading service that sets us apart from the rest. We understand that you may have existing broker relationships, but why not give us a try and get a free quote/rate comparison.

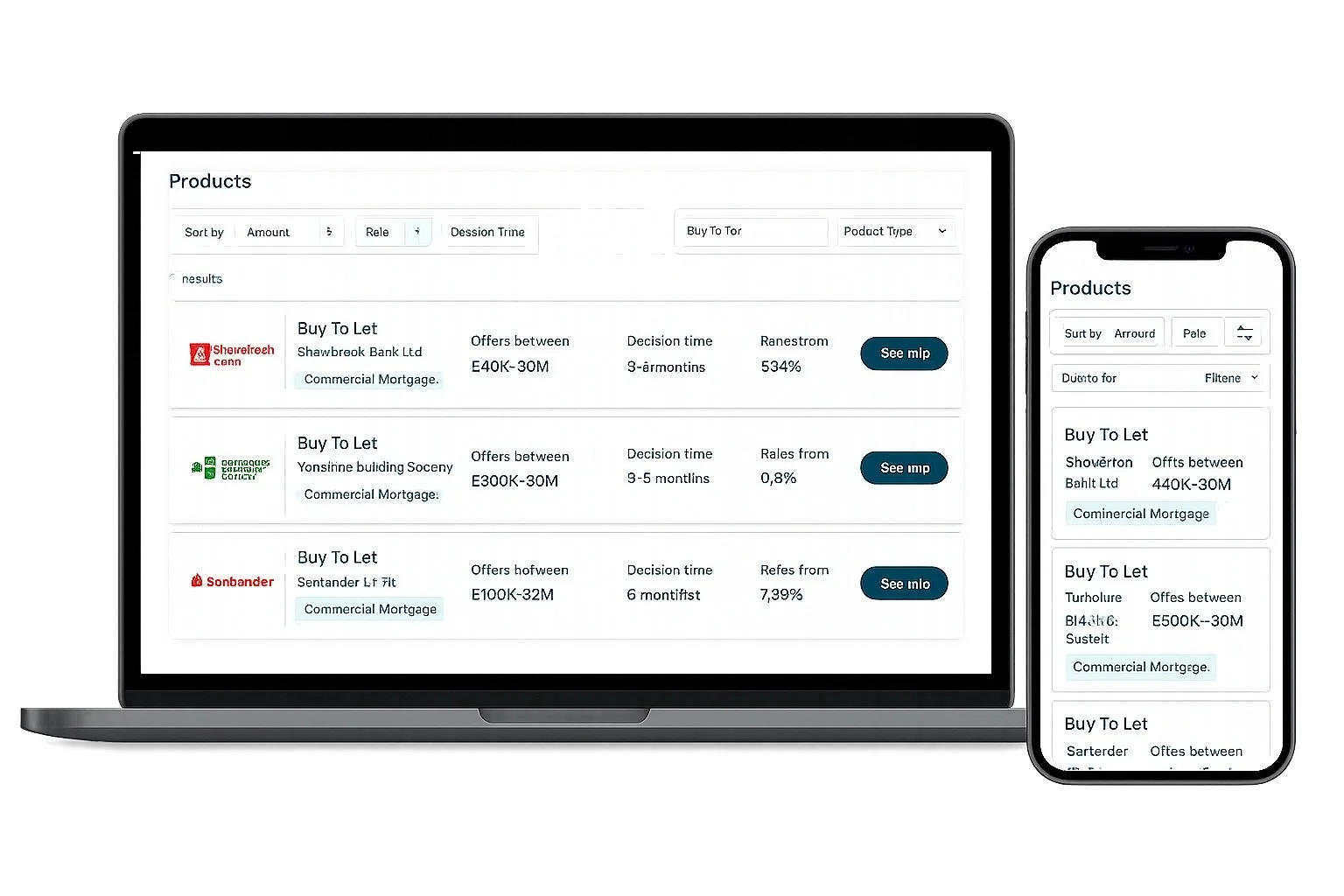

Access The Best Rates

We’ll compare the top lenders in the market to find the best deal for you and your business. With access to 160+ lenders we’ve got the key to unlock the funding you need.

No Upfront Broker Fees ✅

We only get paid when the job is done, we don’t ask for any payment upfront for our time and services. That’s just part of our market leading service.