Apartments/Flats - Development Funding

Free Development Quote/Rate Comparison ✅

Trusted By Property Professionals Nationwide ✅

Get In Touch Today ✅

Free Development Quote/Rate Comparison ✅ Trusted By Property Professionals Nationwide ✅ Get In Touch Today ✅

Hours

Monday–Friday

9am–6pm

Email

info@thefundinggroup.co.uk

Phone

08000 699 500

Location

Southgate Chambers, 37 Southgate Street, Winchester, SO23 9EH

Unlock The Potential In Every Site With Smart Finance That Works For You ✅

Rates From 0.55% ✅

Same Day Finance Assessment ✅

Flexible Project Funding ✅

Up to 70% LTGDV Available ✅

First Time Developer Friendly ✅

Bridge-To-Exit Solutions ✅

Specialist Lender Access ✅

Mixed Use Schemes ✅

Build & Scale Your Portfolio ✅

Apartments & Flats Development Funding

Funding for apartment and flat developments is designed for developers looking to purchase, build, or convert properties into residential units. Whether you’re developing a single block or a multi-unit scheme, this finance provides the capital and flexibility needed to deliver high-quality, profitable developments.

Apartment and flats development finance is ideal when:

✅ You’re building new apartments or flats

✅ You’re converting commercial or larger residential properties into multiple units

✅ You need funds to complete refurbishment or fit-out works

✅ You want to refinance bridging or short-term finance

✅ You’re funding through a Limited Company or SPV

✅ You want to align your finance with your sales or exit strategy

At The Funding Group, we help developers access competitive finance tailored for apartment schemes, with clear guidance and support at every stage.

Common Use Cases for Apartments & Flats Development Funding

We support developers with finance for:

🏢 New-build apartment blocks

🧱 Conversions of houses, offices, or commercial buildings into flats

📦 Part-built or stalled schemes needing completion

🔁 Bridging exit or refinance on completed apartment units

🏘️ Multi-phase residential developments

💼 SPV purchases and portfolio expansions

🛠️ Refurbishments or interior fit-outs to maximise rental or sales value

Every project is different — we match your scheme to the right lender, funding structure, and term.

How We Work

Apartment development finance can be complex — we make it simple.

📞 Initial Chat (Same Day)

We assess your site, GDV, number of units, development stage, and experience to find the right lenders.

📄 Indicative Terms Within 24 Hours

We shortlist lenders based on project size, risk profile, timeline, and exit plan.

🏢 Valuation & Underwriting

We coordinate valuations, prepare documentation, and liaise with lenders to keep the process moving.

💷 Fast, Confident Drawdowns

Most apartment development finance completes within 2–6 weeks, depending on complexity and lender requirements.

We manage the entire process — from enquiry to drawdown.

Why Developers Choose The Funding Group

We help you:

💼 Access finance for new-build or conversion projects

📊 Structure funding to maximise profitability and minimise risk

🚀 Scale apartment developments efficiently

🔁 Refinance bridging or short-term loans with ease

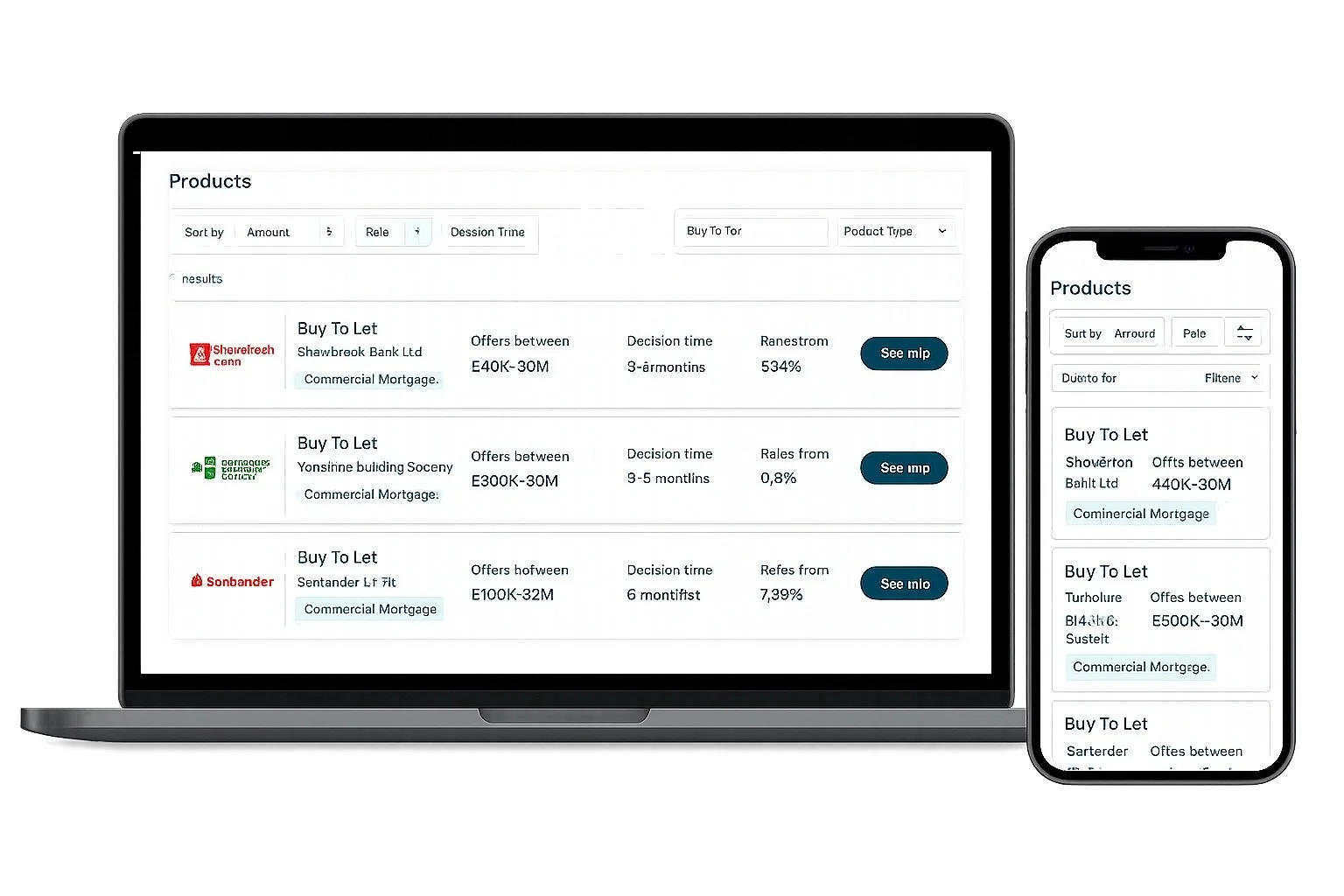

💡 Access specialist lenders not available on the high street

🏢 Navigate multi-unit valuations and lender criteria with confidence

We support your development strategy with speed, clarity, and certainty.

Need Development Finance For Apartments/Flats?

We’re here to help you secure the right funding for your project — quickly and transparently.

✅ Fast decisions

✅ Expert guidance for apartment developments

✅ End-to-end support from enquiry to drawdown

👉 Get a same-day quote or call 08000 699 500

Apartment & Flat Development Finance FAQs

How much can I borrow?

Lenders typically offer 60–75% of land and construction costs, depending on the scheme size and valuation.

Can I get finance for conversions?

Yes — many lenders provide funding for converting houses, offices, or commercial buildings into flats.

Do I need development experience?

Not always, but prior experience helps, especially for larger or complex schemes.

What rates are available?

Rates depend on scheme type, size, and exit strategy, usually starting from around 0.55% per month.

Trusted By Property Professionals Nationwide ✅

It makes us proud that our clients come back to us over and over again…. It’s due to our market leading service that sets us apart from the rest. We understand that you may have existing broker relationships, but why not give us a try and get a free quote/rate comparison.

Access The Best Rates

We’ll compare the top lenders in the market to find the best deal for you and your business. With access to 160+ lenders we’ve got the key to unlock the funding you need.

No Upfront Broker Fees ✅

We only get paid when the job is done, we don’t ask for any payment upfront for our time and services. That’s just part of our market leading service.