Development Exits - Bridging Loans

Free Bridging Quote/Rate Comparison ✅

Trusted By Property Professionals Nationwide ✅

Get In Touch Today ✅

Free Bridging Quote/Rate Comparison ✅ Trusted By Property Professionals Nationwide ✅ Get In Touch Today ✅

Hours

Monday–Friday

9am–6pm

Email

info@thefundinggroup.co.uk

Phone

08000 699 500

Location

Southgate Chambers, 37 Southgate Street, Winchester, SO23 9EH

Fast, Flexible Bridging Finance When You Need It Most ✅

Rates From 0.55% Per Month ✅

Same Day Terms Offered ✅

Desktop Valuations Possible ✅

New SPVs (No History) ✅

Up to 90% Purchase Price ✅

Retained Interest Option ✅

Quick Completions ✅

Exits on to BTL Mortgage ✅

Below Market Value ✅

Why Use Development Exit Bridging?

Development exit bridging finance is designed for property developers who need short-term funding to exit a development project — whether to refinance, repay a construction loan, or prepare for sale.

It’s ideal when:

🏗️ Your development is complete or near-complete

💷 You need funds to repay short-term loans or cover costs

📈 You want to refinance into longer-term finance (e.g., commercial mortgage, BTL)

⚡ You need fast access to capital to free up your balance sheet

🏡 You plan to sell or let the completed development

At The Funding Group, we specialise in bridging solutions for developers, helping you move smoothly from project completion to exit.

Development Exit Bridging Use Cases

We help investors and developers with:

🏘️ Buy-to-Sell Developments — fund exit until sale completes

🏗️ Build-to-Rent Projects — bridge into long-term BTL mortgages

📈 Refinancing Existing Loans — repay construction finance

💼 Portfolio Developments — free up capital for next project

⏳ Time-Sensitive Sales — ensure funds are ready for immediate exit

Every development exit is different — we structure the lender, product, and term around your project completion and exit plan.

How Development Exit Bridging Works

Lenders typically provide:

💷 70–75% of the completed property value

📈 Terms of 3–18 months to give enough time to refinance or sell

🔧 Option to include minor snagging or finishing costs

⚡ Fast approvals to release funds as soon as the development completes

We manage the valuation, lender coordination, and fund release so you can repay your existing finance or hold until your exit.

How We Work

📞 Initial Chat — Same Day

We assess your development status, costs, and exit plan.

📄 Terms Within 24 Hours

We match you with lenders who specialise in development exit finance.

🔍 Valuation & Fund Release

We liaise with surveyors and lenders to ensure smooth fund access.

💷 Quick Completion

Funds are often released within 7–14 days of completion, depending on the project.

Why Developers Choose The Funding Group

We help you:

🔥 Free up capital from completed developments

📈 Refinance efficiently onto longer-term finance

🏗️ Cover short-term costs or final snagging

⚡ Move fast on new projects without waiting for existing ones to sell

💼 Plan exits for maximum returns

We don’t just provide funding — we help you complete the cycle from development to profitable exit.

Development Exit Bridging FAQs

Can this cover minor finishing costs?

Yes — lenders often include snagging and completion-related expenses.

Do I need experience?

Experience helps but lenders focus on completed development value and exit strategy.

How fast can I get funds?

Funds can often be released within 7–14 days.

What rates are available?

Rates start from 0.55% per month, depending on lender and project risk.

Trusted By Property Professionals Nationwide ✅

It makes us proud that our clients come back to us over and over again…. It’s due to our market leading service that sets us apart from the rest. We understand that you may have existing broker relationships, but why not give us a try and get a free quote/rate comparison.

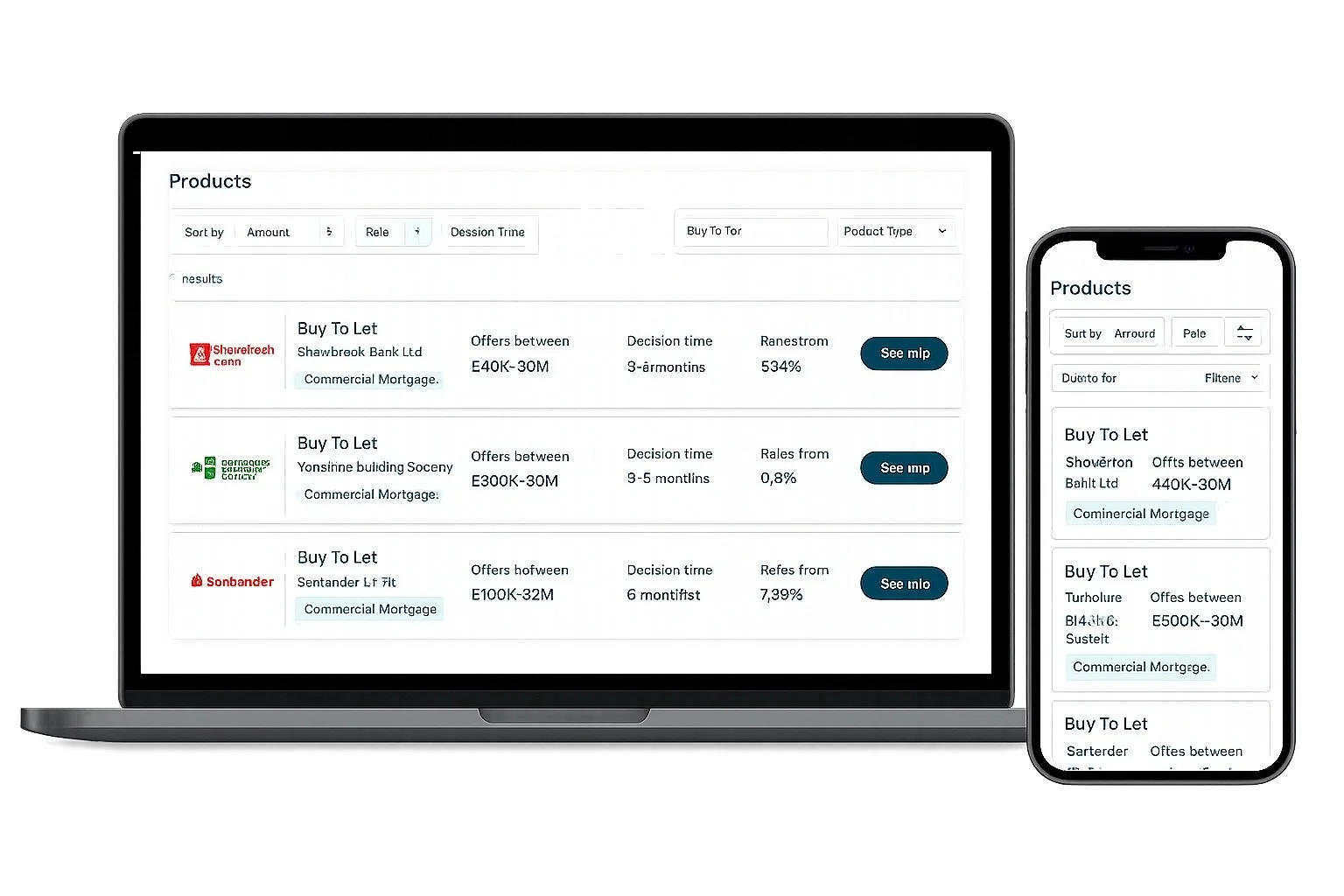

Access The Best Rates

We’ll compare the top lenders in the market to find the best deal for you and your business. With access to 160+ lenders we’ve got the key to unlock the funding you need.

No Upfront Broker Fees ✅

We only get paid when the job is done, we don’t ask for any payment upfront for our time and services. That’s just part of our market leading service.