Auction Property Finance - Fast, Flexible Finance Secured In 48-72 Hours

Why Use Auction Finance

Auction finance is a fast, flexible solution designed for buyers who need to complete within tight timeframes — typically 28 days or less. Whether you're a seasoned investor or a first-time buyer, bridging finance is ideal when:

✅ You’ve just won a property at auction and need to complete quickly

✅ Traditional mortgages can’t move fast enough

✅ The property is unmortgageable in its current condition

✅ You're buying below market value and need to act fast

✅ You want to refurb, flip, or let the property after purchase

At The Funding Group, we help clients across the UK secure auction finance with expert guidance and lightning-fast decisions — so you can buy with confidence, knowing the funding is in place.

Auction Finance Use Cases

We help investors, landlords, and developers secure bridging loans for:

🏚️ Buying uninhabitable or non-standard properties at auction

🔨 Refurbishing or converting auction wins before refinancing

📈 Capitalising on below-market-value deals with fast completions

⏳ Completing within 28 days to meet auction house deadlines

🧱 Bridging gaps between purchase and long-term buy-to-let or exit funding

Every auction purchase is unique — that’s why we tailor the lender, product, and structure around your specific timeline and exit strategy.

How We Work

At The Funding Group, we move fast — without cutting corners.

📞 Initial Chat (Same Day)

We assess your deal, confirm it's fundable, and explain the auction finance process clearly.

📄 Terms in 24–48 Hours

We shortlist lenders based on speed, rate, and flexibility — and get you terms fast.

🏡 Valuation & Legal Process

We coordinate with lenders, valuers, and solicitors to ensure the deal progresses smoothly and rapidly.

💷 Funds Released in 5–10 Days

Most clients complete well within the 28-day auction deadline. Faster turnarounds are available.

We don’t just find you a loan — we manage everything end to end to make sure your purchase completes on time.

Buying at Auction? Move Fast with Confidence

We’re your auction finance partner — working with trusted UK lenders to fund your property purchases quickly and reliably.

✅ Fast answers

✅ Dedicated support

✅ Auction deals done properly

👉 Get a same-day quote or call us now on 08000 699 500

Auction Finance FAQs – Answered

How much can I borrow?

Anywhere from £50,000 to £25 million+, depending on the property and your exit strategy.

Do I need to prove income?

Not usually — most auction loans focus on the property value and how you'll repay or refinance.

How long does the loan last?

Typically 3 to 12 months, with many clients refinancing or selling earlier. Early repayment is usually penalty-free.

How much does it cost?

Rates start from 0.55% per month. Your rate depends on speed, experience, loan size, and risk profile.

Secure Up to £25M in Auction Finance for Property Investments and Fast Completions

Hours

Monday–Friday

9am–6pm

Email

info@thefundinggroup.co.uk

Phone

08000 699 500

Location

Southgate Chambers, 37 Southgate Street, Winchester, SO23 9EH

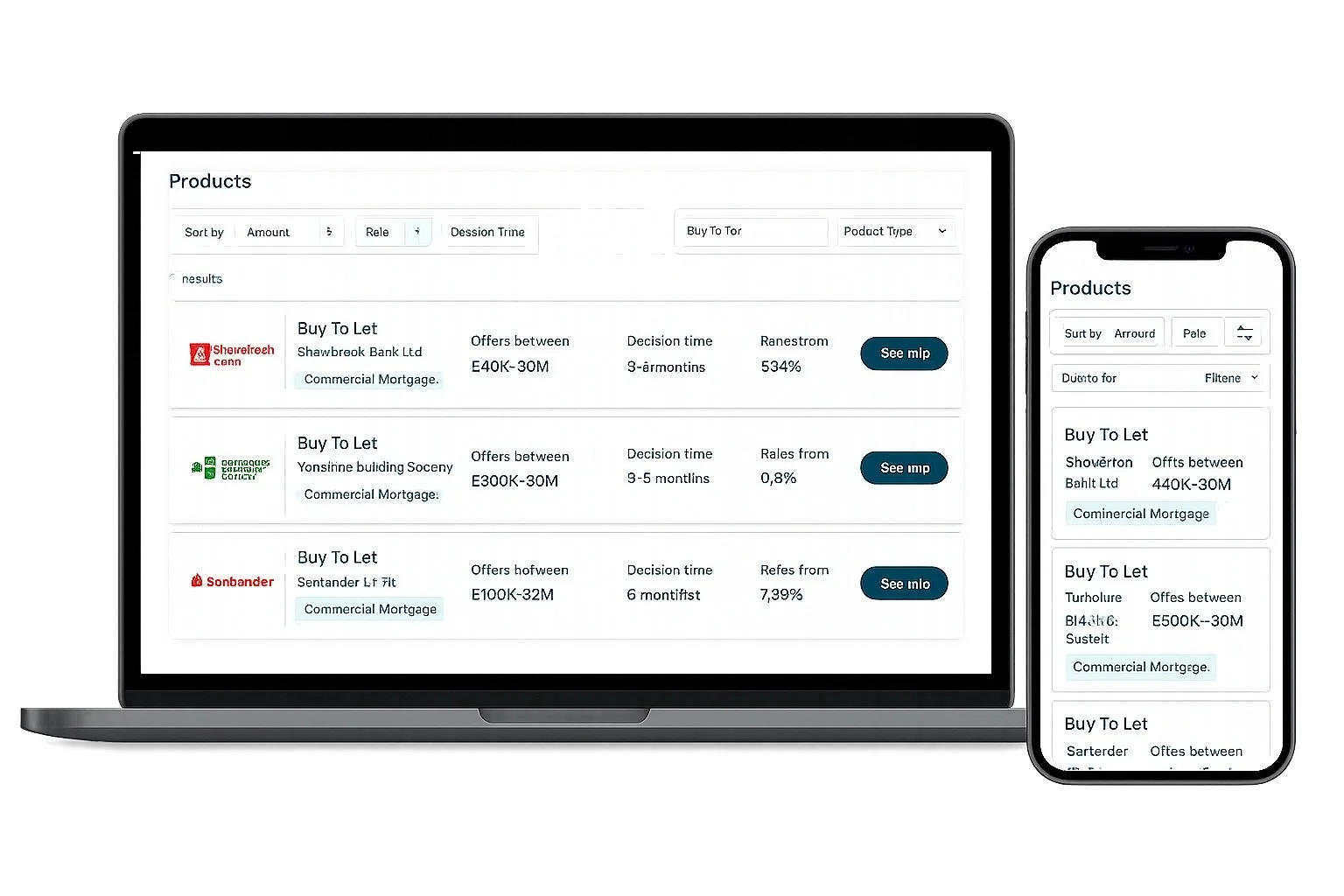

Access The Best Rates

We’ll compare the top lenders in the market to find the best deal for you and your business. With access to 160+ lenders we’ve got the key to unlock the funding you need.

Auction Finance Experts - Trusted By Property Professionals Nationwide

Tell Us What You Need

We Don’t Charge Upfront Broker Fees

We only get paid when the job is done, we don’t ask for any payment upfront for our time and services. That’s just part of our market leading service.