Bridging Loan Broker- Fast, Flexible Finance Secured In 48-72 Hours

Why Use a Bridging Loan

Bridging loans are fast, flexible funding solutions designed to “bridge” a gap — whether between purchase and sale, auction win and mortgage, or buying un-mortgageable property. They’re ideal when:

✅ You need to complete within 28 days (e.g. auctions)

✅ You're buying below market value but need to move quickly

✅ You’re stuck in a chain break and risk losing your onward purchase

✅ You’re converting or refurbishing a property not currently suitable for a mortgage

✅ You want to act fast on a below‑market opportunity

At The Funding Group, we help clients across the UK navigate time-sensitive property finance with expert support and fast decisions.

Common Bridging Loan Use Cases

We help property developers, landlords, and investors secure bridging finance for:

🧱 Converting commercial spaces into residential units

🏚️ Refurbishing older homes before resale

🏗️ Funding ground-up developments or extensions

🔄 Breaking chains for buyers waiting on other sales

🛠️ Purchasing fire-damaged or uninhabitable properties

Every deal is different — so we tailor the lender, product, and structure to your specific needs.

How We Work

At The Funding Group, we act fast — without sacrificing diligence.

Initial Chat (Same Day)

We take a quick overview of your deal, confirm it’s fundable, and explain the process.

Terms in 24–48 Hours

We prepare a short list of lenders based on speed, cost, and flexibility — then issue terms quickly.

Valuation + Legal Process Begins

We coordinate with lenders, surveyors, and your solicitors to move the deal forward every day.

Funding Secured

Most clients receive funds within 5–10 days. Urgent cases can be completed faster.

We don’t just "source" loans — we manage the process end to end to get deals across the line.

Ready to Move Fast on Your Property Deal?

We’re your dedicated bridging finance partner — working exclusively with trusted UK lenders to secure the best outcomes for your project.

✅ Fast answers.

✅ Straightforward advice.

✅ Bridging done properly.

👉 Get a same-day quote or call us on 08000 699 500

Common Bridging Questions – Answered

How much can I borrow?

Typically from £50,000 to £25 million+, depending on your property and exit strategy.

Do I need to prove income?

In most bridging cases, income proof is not required — the focus is on the property and your exit plan.

What’s the loan term?

Most bridging loans run from 3 to 12 months. You can repay early, often with no penalties.

How much does bridging finance cost?

Rates start from 0.55% per month, but depend on your credit, experience, LTV, and speed required.

Secure Up To £25M In Bridging Finance For Auction Purchases, Investment Properties And Development Deals

Hours

Monday–Friday

9am–6pm

Email

info@thefundinggroup.co.uk

Phone

08000 699 500

Location

Southgate Chambers, 37 Southgate Street, Winchester, SO23 9EH

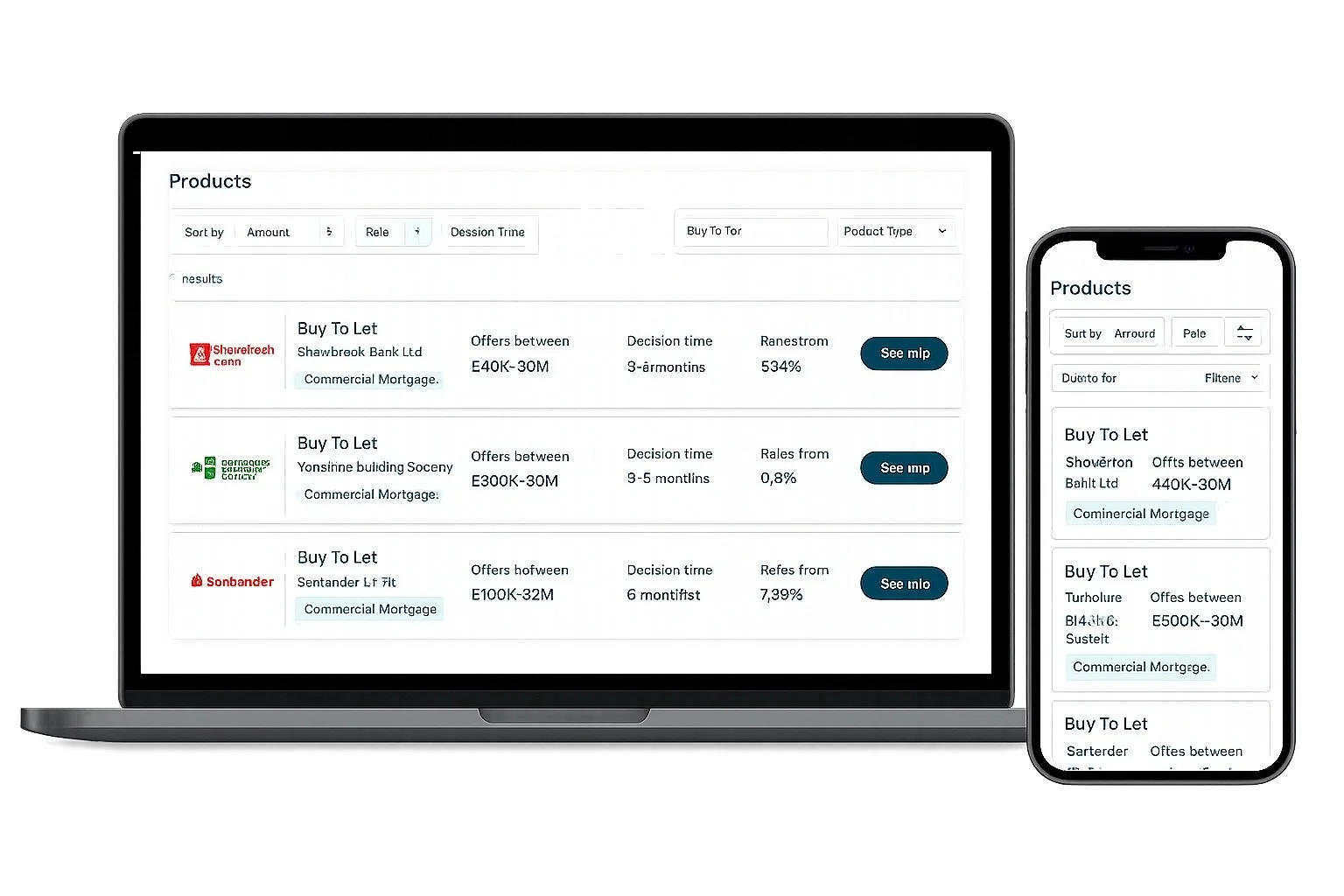

Access The Best Rates

We’ll compare the top lenders in the market to find the best deal for you and your business. With access to 160+ lenders we’ve got the key to unlock the funding you need.

Bridging Loans Experts - Trusted By Property Professionals Nationwide

Tell Us What You Need

We Don’t Charge Upfront Broker Fees

We only get paid when the job is done, we don’t ask for any payment upfront for our time and services. That’s just part of our market leading service.